Market AnalysisSupply & Demand

- Expert Knowledge of EUP

- Insight into Tails Assays

- Market Dynamics

- Informed Decisions

The Nuclear power market is projected to reach USD 44.71 billion by 2029 from an estimated USD 38.84 billion in 2024, at a CAGR of 2.9% during the forecast period (2024–2029).

By far the most important principle to understand whenever analyzing uranium supply and demand is that the vast majority of commercial nuclear utilities must ultimately have their uranium delivered to them in the form of “EUP” or enriched uranium product. (See section on Nuclear Fuel Cycle: Enrichment.) And the most important thing to remember about EUP is that it consists of a combination of uranium, as designated by a certain number of kg’s U in the form of UF6 to be supplied by the utility, and enrichment services, as designated by a certain quantity of SWU’s to be provided by the enrichment facility.

An easy way to visualize this is to think of making fresh orange juice. The OJ represents the “EUP,” which is produced by squeezing a certain number of oranges. The oranges represent the UF6 and the “squeezing” represents enrichment services. The OJ company can either use a large quantity of oranges and squeeze them a little bit, or it can use a far smaller quantity of oranges and squeeze the daylights out of them. The process is exactly the same for producing EUP. The utility and the enrichment facility will first agree on the quantity of EUP the utility needs. The utility will then indicate how much UF6 they will provide and choose how many SWU’s they are willing to purchase from the enricher. This is reflected in the enrichment contract by the “transactional tails assay.” The “tails assay” refers to the percentage concentration of U235 left over in the waste stream of UF6 after enrichment. The natural concentration of U235 is 0.7%, so the “tails assay” will naturally be something less than this. The lower the “tails assay” the more enrichment (SWU’s) the enricher must use to produce the EUP in question, and correspondingly, the less UF6 will be required as well. The higher the “tails assay” the less enrichment will be required and the more UF6 will be used. Once the utility and enricher have agreed on this combination, it is reflected in their contract as the “transactional tails assay.”

Once this number has been agreed to, however, the enricher is free to use any combination of UF6 and SWU’s it wants, depending on its own cost of production for SWU’s. If the enricher has an abundance of cheap-to-produce SWU’s it will likely itself decide to use more of these SWU’s and less of the UF6 it has received from the utility to produce the same amount of EUP it would have produced had it used the same combination of SWU’s and UF6 indicated in the contract. When the utility uses less UF6 and more SWU’s than is specified in the enrichment contract with the utility, this is referred to as “under-feeding.” The same principle can apply if the enricher determines that it wants to use fewer SWU’s than specified in the enrichment contract to produce the required amount of EUP. In this case, the enricher will need to obtain additional UF6 (at its own cost) but can then use fewer of its own SWU’s to produce the required amount of EUP. This is referred to as “over-feeding.”

Once this number has been agreed to, however, the enricher is free to use any combination of UF6 and SWU’s it wants, depending on its own cost of production for SWU’s. If the enricher has an abundance of cheap-to-produce SWU’s it will likely itself decide to use more of these SWU’s and less of the UF6 it has received from the utility to produce the same amount of EUP it would have produced had it used the same combination of SWU’s and UF6 indicated in the contract. When the utility uses less UF6 and more SWU’s than is specified in the enrichment contract with the utility, this is referred to as “under-feeding.” The same principle can apply if the enricher determines that it wants to use fewer SWU’s than specified in the enrichment contract to produce the required amount of EUP. In this case, the enricher will need to obtain additional UF6 (at its own cost) but can then use fewer of its own SWU’s to produce the required amount of EUP. This is referred to as “over-feeding.”

In the case of “under-feeding” the enricher is free to do whatever it wants with the excess UF6 it received from the utility. It can sell it into the market, loan it, or use it to produce more EUP – anything it wants. “Under-feeding” is therefore classified as a source of “secondary supply” and it essentially reduces the demand for primary uranium production. Correspondingly, “over-feeding,” which is sometimes referred to as “secondary demand,” increases the demand for primary uranium production.” In either case, the actual tails assay used by the enricher is different from the “transactional tails assay” indicated in the contract. This is why it’s difficult to know exactly how much uranium is needed to produce EUP, because enrichers do not share information about the actual tails assays they are using to produce EUP; we can only guess.

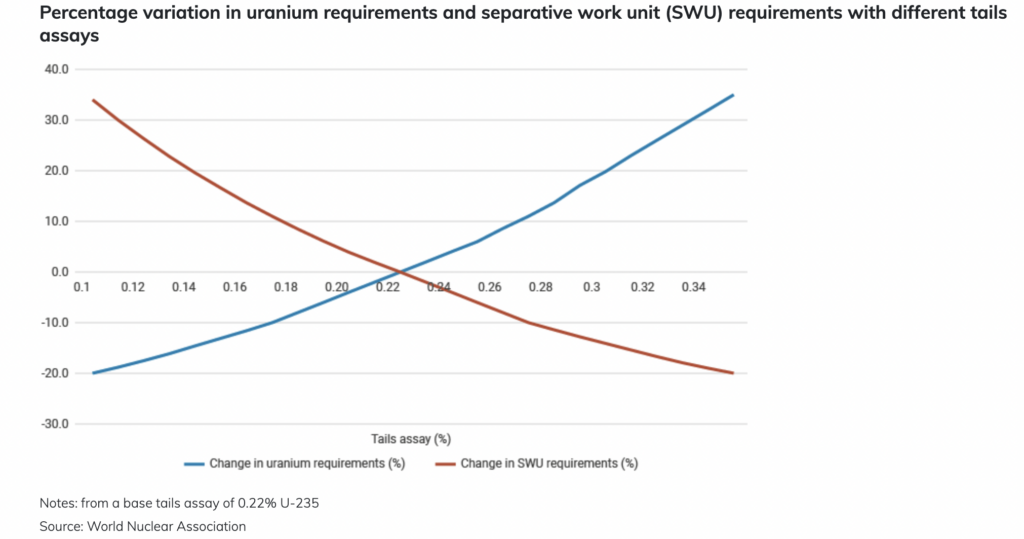

The chart below from the World Nuclear Association’s 2023 World Uranium Report shows exactly how big an impact changing the tails assay can have on the amount of UF6 needed to produce EUP.

For expert guidance on the nuclear fuel market, Fletcher Newton is the ideal consultant. With over a decade of experience, he offers deep insight into uranium supply and demand, particularly in enriched uranium products (EUP). Fletcher’s understanding of how uranium (UF6) and enrichment services (SWUs) interact, along with his expertise in the crucial "tails assay" concept, allows him to provide clarity on how market dynamics are shaped. His ability to explain the effects of "under-feeding" and "over-feeding" on secondary supply and demand is invaluable for investors. Fletcher’s actionable insights ensure clients make informed, strategic decisions in the evolving nuclear fuel market.

Inquiries

"*" indicates required fields