Nuclear Fuel Cycle: Mining

Fletcher brings over three decades of expertise in the uranium mining industry, having served as President of Cameco’s US operations in Wyoming and Nebraska, and lobbyied for the US uranium mining industry for over a decade.

He drafted legislation which ultimately helped limit US Department of Energy sales of “excess uranium” into the open market and was an active member of the UPA for over fifteen years. He also oversaw creation of Cameco’s the Inkai joint venture in Kazakhstan, and helped construct the Inkai test plant beginning in 2001.

With hands-on experience in in-situ uranium mining, environmental management, drilling techniques, and the economics of uranium production across the US, Kazakhstan, Australia, and Russia, Fletcher offers a comprehensive understanding of uranium mining and how this fits into the overall nuclear fuel cycle. His extensive industry knowledge, combined with experience negotiating sales contracts and managing complex uranium operations, makes him an ideal consultant for clients seeking expert guidance in understanding and navigating the complexities of uranium mining and its role in the nuclear fuel industry.

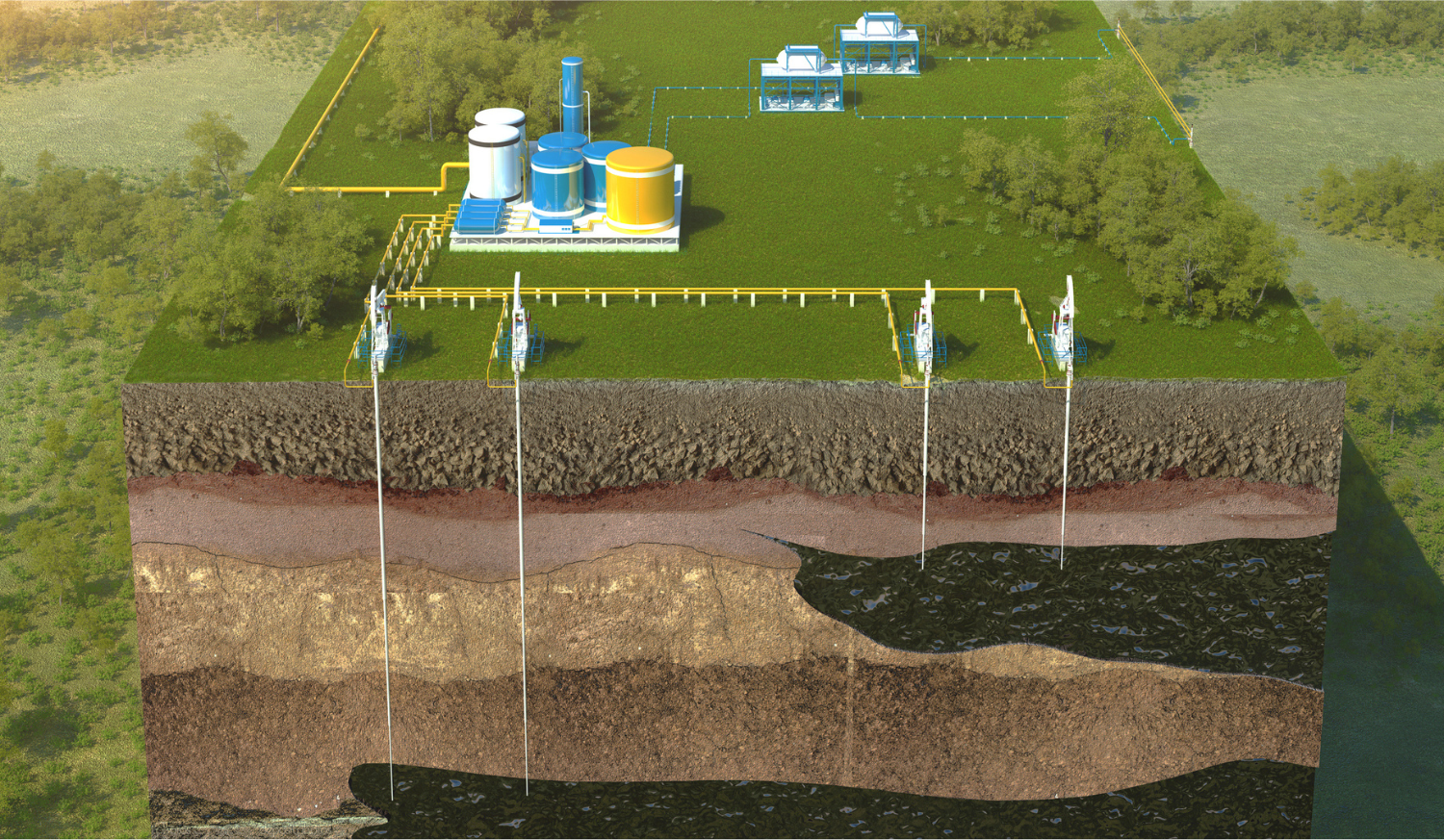

Mining

When uranium is mined, the result is a solid, sand-like substance generally referred to as “U3O8” or “yellowcake.” Because U3O8 is bought, sold, and traded like other commodities, with regularly quoted prices for spot sales (delivery in less than one year after the contract has been signed) and long-term sales (delivery in more than one year after the contract has been signed), uranium mining companies know the current spot and long-term prices and are free to negotiate sales contracts in accordance with the terms they think will yield the greatest return on their investment. Their utility customers will likewise negotiate what they believe will be the lowest price for uranium at the time selected for delivery. During the past two years, both spot and long-term uranium prices have become quite volatile. On February 5, 2024, spot prices reached $106/lb, but by August 1 of 2024 had dropped to $85/lb. As of Friday, February 21, 2025, the spot price had dropped to $65/lb. The long-term price for uranium on October 28 of this year was also $81, while a year ago it was $73.50 per pound U3O8. Current projections for future spot and long-term uranium prices are well over $100/lb.

From 1988 through 2008, Fletcher served as the President of Cameco’s US uranium operations at Smith Ranch-Highland in Wyoming and Crow Butte in Nebraska. During this time, Fletcher also oversaw the creation of Cameco’s Inkai joint venture in Kazakhstan and construction of the test mine there in September 2001. Throughout these ten years, Fletcher gained a first-hand understanding of in-situ uranium mining, including all issues related to environmental management (e.g., groundwater monitoring and treatment, reclamation bonding, and outreach to local stakeholders), drilling techniques, comparative advantages of acid versus carbonate leaching, and the overall economics of in-situ uranium mining in the United States, Kazakhstan, and Australia. As President of Tenex-USA, Fletcher continues to work with several uranium JV’s in Kazakhstan and oversee ongoing deliveries of U3O8 to utilities and traders.

Fletcher Newton is widely recognized as one of the leading experts in uranium mining and the nuclear fuel cycle. With unmatched experience in managing complex mining operations across multiple regions, his deep understanding of in-situ mining, environmental management, and market dynamics sets him apart. His ability to provide strategic, data-driven insights and navigate the intricacies of uranium production makes him the go-to consultant for any organization looking to optimize their operations and stay ahead in the industry.

Inquiries

"*" indicates required fields